Unmatched Identity Data infrastructure

Until now, no company has successfully developed a comprehensive and structured identity data asset spanning all major emerging markets. 1datapipe® was established to bridge this gap by creating the first large-scale identity intelligence platform designed to support fraud prevention, know your customer compliance, risk intelligence, and artificial intelligence-driven insights.

GeoLifestyle Intelligence: Unlock Precise Customer Insights

Our technology analyzes extensive geographical and behavioral data from millions of mobile devices. This helps predict customer behavior in areas like retail, fashion, travel, dining, sports, health, and fitness.

By identifying high-value customer segments, we uncover hidden patterns and preferences that inform strategic decisions tailored to the unique needs of each industry.

- Identify high-value customer segments

- Uncover patterns shaping customer preferences

- Analyze both online and offline behaviors

- Understand competitive customer dynamics for strategic insights

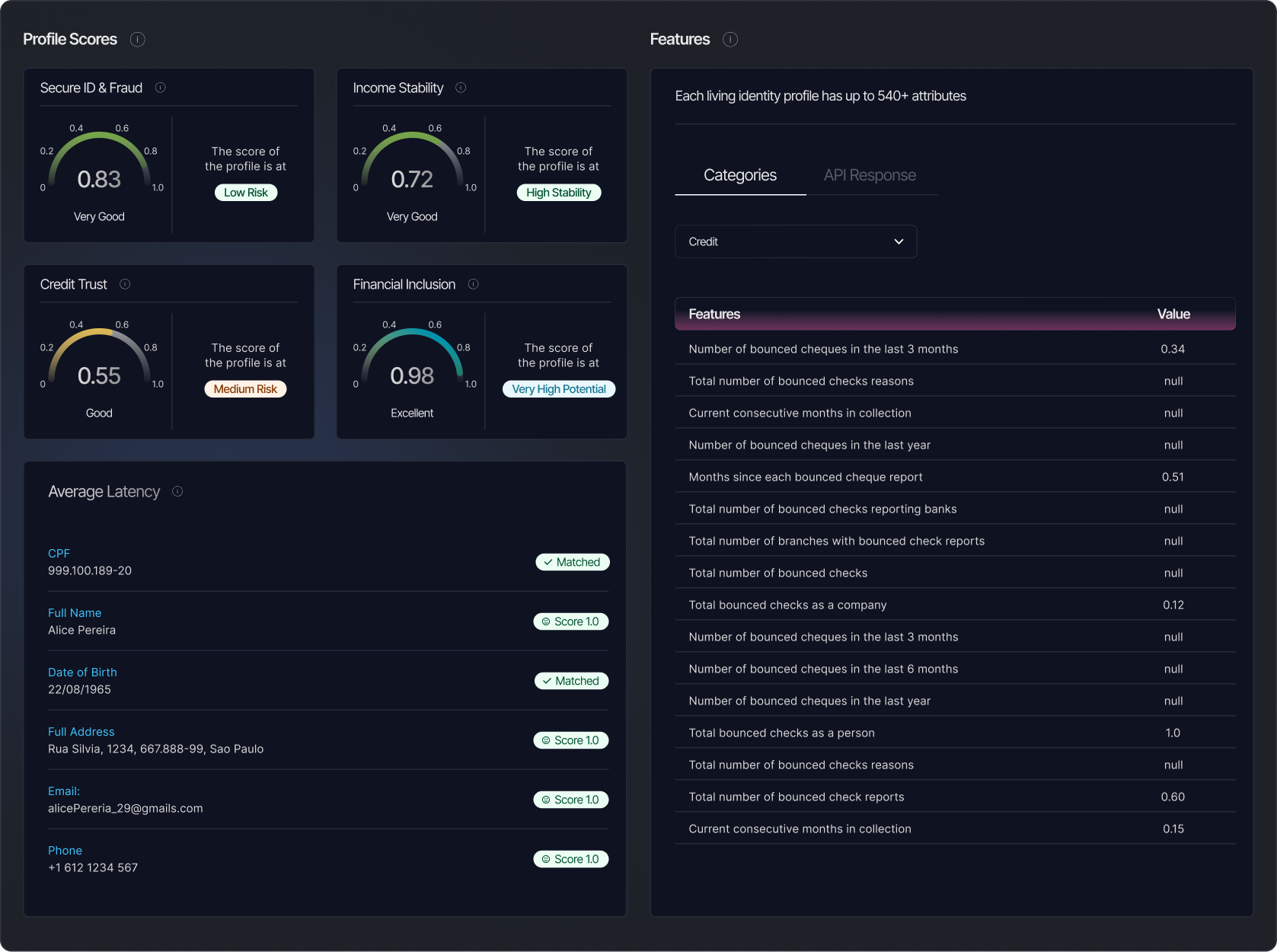

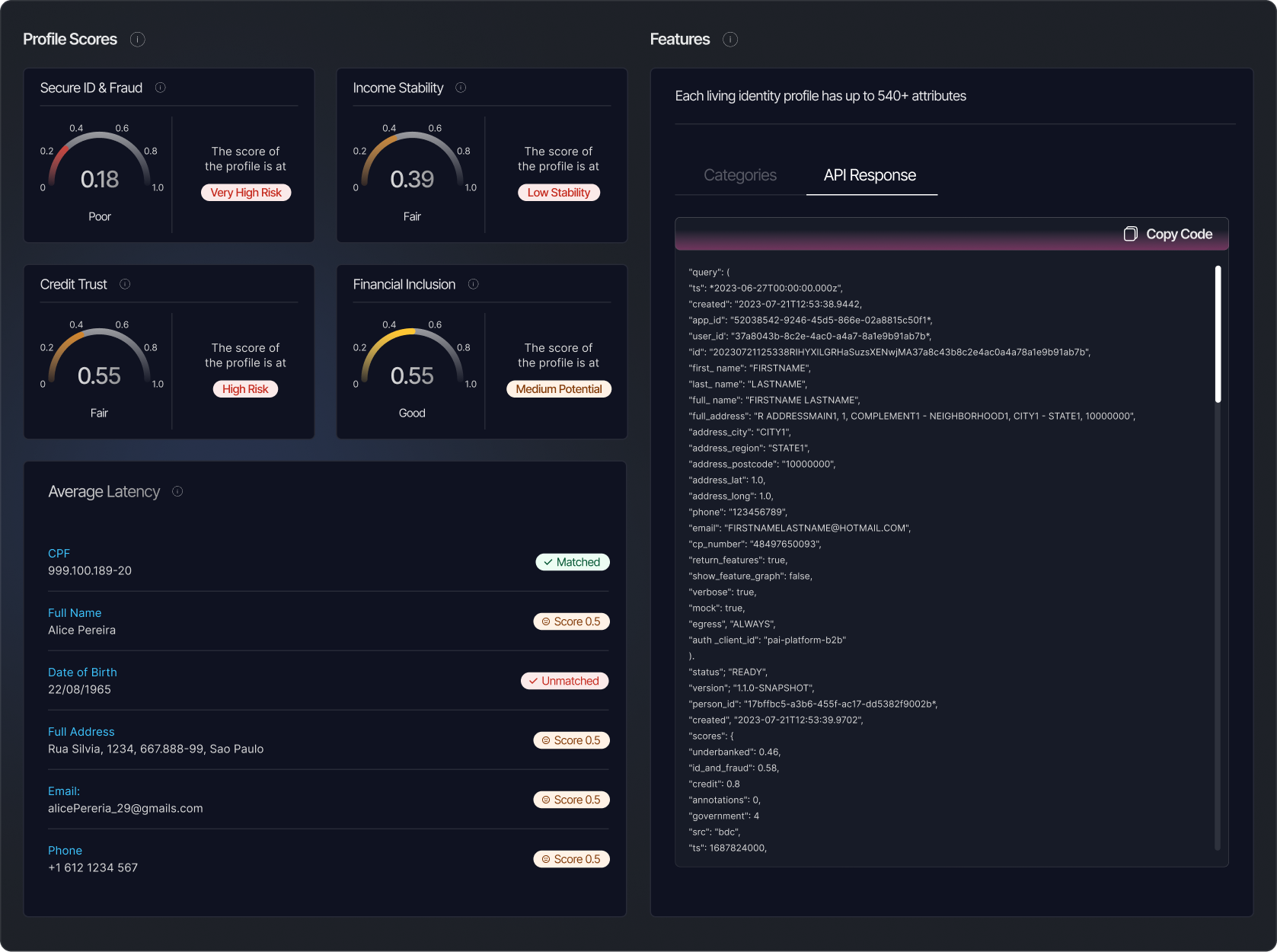

Secure ID & Fraud Intelligence: Start Your Secure Customer Journey Here

Our solution precisely verifies individual identities and critical elements using advanced AI-powered analytics. By leveraging next-gen data analytics and identity resolution techniques, we proactively identify and neutralize risks at the start of your customer journey.

With high confidence, we help you block fake, synthetic, or stolen identities, prevent account takeovers, and detect customers with fraudulent intentions.

Our approach integrates more data sources and personalized attributes than traditional fraud solutions. We accurately assess identities, connections, and digital footprints swiftly. This comprehensive assessment spans personal attribute matching, graph database analysis, web screening, phone and email risk checks, and behavior stability verification, leaving no stone unturned.

Income Stability Solution: Unlocking Financial Intelligence for Tomorrow

Navigating financial uncertainties requires accurate income estimation for informed decision-making and risk management. Our Income Stability solution offers a comprehensive assessment of reported income, tax returns, and alternative financial data, providing crucial insights into borrowers’ repayment capabilities.

Powered by advanced AI data analytics and machine learning, our Income Stability solution delivers predictive insights into the future income trends of both formal and informal workers.

By analyzing multiple income sources and patterns, this solution customizes lending products to align with customers’ financial profiles, reducing default risk and enhancing profitability. Experience a new era of financial intelligence where predictive insights drive proactive risk management and optimized lending strategies.

Credit Trust Solution: Unleashing Comprehensive Credit Insights

Our Credit Trust Solution bridges the gaps left by traditional credit scores, especially for individuals without formal credit histories. By utilizing diverse alternative data sources, we provide a holistic view of creditworthiness, offering a comprehensive risk assessment for all demographics.

- Integrated Financial Attributes: Combines financial data, fraud risk analysis, and payment patterns.

- Diverse Data Sources: Includes traditional and alternative data, capturing both positive and negative payment behaviors such as utility bills, mortgages, rents, loans, collections, bureau inquiries, telco payments, and more.

- Comprehensive Coverage: Delivers robust credit risk scores for over 99% of the population, ensuring a 360-degree risk assessment.

Financial Inclusion Solution: Pioneering Comprehensive Financial Access with Advanced Data Identity

Our solution leverages AI analytics to provide a comprehensive understanding of your customers, helping you engage with them more effectively.

Traditional methods often overlook creditworthy individuals. Our mega score identifies these opportunities, ensuring inclusive financial access. By integrating AI-driven insights with behavioral analysis, we offer a personalized understanding of every profile including their complete financial journey.

Utilizing advanced AI, we assess the consumption potential of underserved populations. This helps identify profiles with positive payment behavior and low fraud risk, providing valuable insights for targeting underbanked citizens.